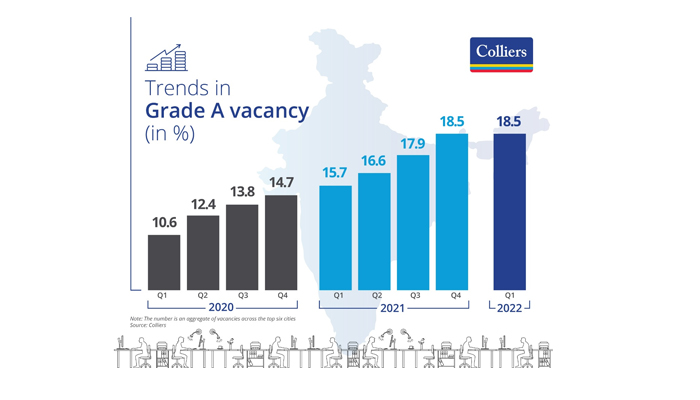

After a gap of two years, vacancy across Grade A office markets across the top six cities has not increased for the first time, and remained stable at 18.5%. Over the last two years, office vacancy has risen every successive quarter led by occupiers exits and slower demand. Along with stable vacancy, during Q1 2022, gross absorption has risen almost 3 times YoY to about 13.0 million sq feet – the highest in two years. This shows that Q1 2022 has been a watershed period for the commercial office sector, with the office sector shrugging off the relatively low demand seen over the last two years. The office market started picking up since H2 2021, with the momentum continuing onto Q1 2022 too. This has been led by large deals returning to the market, well supported by an infusion of quality supply across the prominent markets.

Bengaluru continued to be the top market with a share of 31% of the overall Grade A absorption during the quarter. Pune, interestingly, pipped larger markets and shared the second spot along with Hyderabad at 17% each. Compared to other cities, demand momentum in Delhi-NCR and Mumbai was relatively slower, as few large deals have been pushed to the subsequent quarters.

During the quarter, supply doubled to about 14.3 million sq feet. The new supply was led by Bengaluru with a share of 29%. This was followed by Chennai and Pune with a share of 22% each of the total supply.

Trends in Grade A supply (Nos in mn sq ft)

| Q1 2022 | Q4 2021 | Q1 2021 | YoY | QoQ | |

| Bengaluru | 4.1 | 2.2 | 3.1 | 34% | 88% |

| Chennai | 3.2 | 0.3 | 0.3 | 1111% | 1155% |

| Delhi NCR | 1.0 | 1.4 | 1.1 | -10% | -32% |

| Hyderabad | 2.7 | 5.5 | 1.9 | 41% | -51% |

| Mumbai | 0.1 | 2.1 | 0.6 | -79% | -92% |

| Pune | 3.2 | 1.4 | – | 100% | 126% |

| Pan India | 14.3 | 12.9 | 7.0 | 104% | 11% |

Source: Colliers

Ramesh Nair, CEO, India and Managing Director, Market Development, Asia, Colliers, said “This quarter has seen occupier confidence swinging back with considerable large-sized deals that accounted for a whopping 55% of the leasing during the quarter. This clearly shows that occupiers are consolidating offices as they prepare for workplace-led innovation and collaboration. This strong leasing comes at a time when occupiers in India have started opening their doors to employees after a hiatus of two years. Q2 2022 will be a crucial period as we expect more companies to open up workplaces. If the overall leasing momentum continues, then the year 2022 is likely to be a promising year.” Vimal Nadar, Senior Director and Head of Research Colliers India, said, “Flex spaces are taking up large spaces across cities. Amongst the large-sized deals, flex spaces accounted for about 20%, lagging only behind the technology sector. Pune has seen a spurt in leasing by flex spaces, accounting for about 52% of the leasing by flex spaces. Bengaluru, Hyderabad and Mumbai accounted for 12% each of the total leasing by flex spaces. Flex space operators are focusing on customization and providing on-demand workspaces, attracting small and large occupiers alike.”

Read More News: https://www.enterpriseitworld.com/news/ I Watch CIOtv: https://ciotv.live/ I Read IT Partner News: https://www.smechannels.com/