During 2H 2014 Showing Signs of Growth and Revival: IDC

The software market growth in the second half of calendar year 2014 turned out to be slower than expected owing to prolonged economic revival. As per International Data Corporation (IDC) India Software Tracker for 2H 2014, the India software market registered a stable year on year growth of 10.0%. However, the market is expected to gain a steady momentum starting 2016 and beyond as deals would have closures and implementation would start. Some of the reasons for the stable growth include a steady double digit growth for the top vendors such as SAP, Microsoft, Oracle and the likes. More investments are expected to pour in from sectors such as Government, Manufacturing and Retail among others.

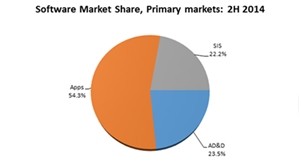

The Indian IT Software market is segregated into three primary markets which include Application Development Deployment (AD&D), Applications and System Infrastructure Software (SIS). The total AD&D market grew by 9.5% year on year while Applications market pegged a growth of 10.8% year on year and SIS market grew by 8.5% year on year during the second half of calendar year 2014. Some of the secondary markets that registered a strong growth during the review period include Application Platforms, Content, Operations & Manufacturing Applications and Integration & Orchestration Middleware among others.

Some of the major transformational projects kick-started by the Government, including Digital India, Make in India, Pradhan Mantri Jan-Dhan Yojana etc. have already pushed the adoption in other sectors too. Further, Small & Medium Enterprises (SME) segment is the new sweet spot for most of the vendors who are trying to push their Software-as-a-Service (SaaS) offerings among SMEs through their various partnerships.

IDC expects the software market to grow at a healthy pace in the next five years (2015-2019) with a CAGR of 10.6%. Some of the software categories that will trigger the uptake include mobile applications, in-memory analytics, database security and privacy, open source applications, DLP, encryption, application security among others.

IDC Top Vendors such as Microsoft, Oracle, SAP, IBM and Synopsys retained their dominant position in the market collectively cornering more than 60% of the total share. Manufacturing, Banking, Finance, Securities and Investment Services (BFSI), IT/ITeS and Communication & Media were the top verticals which invested in next generation solutions to gain a competitive edge in the market. The Union Government has a clear focus on leveraging technology for transformational projects and helps improve infrastructure, build smart cities, address urbanization, revive manufacturing sector among others. Manufacturing companies are making an effort to integrate social media platform with the back end systems to implement feedback during the production stage itself and enhance customer offerings. Use of big data analytics in the retail industry has helped companies to track information generated across multiple platforms such as CRM, Supply Chain Systems, Sensor Data, e-mails, Adsense Analytics and the likes to identify the latest trends and buyer sentiments and re-align their inventory levels accordingly.

“Some of the larger software vendors restructured their organization in line with the emerging technologies and re-aligned their strategies to capture the mindshare in the growth markets such as SMB, cloud, analytics and mobility. This has worked quite well for them and they have managed to grow in spite of the uncertainty in the market,” says Shweta Baidya, Senior Market Analyst, Software, IDC India.