33,662 units shipped in Q2 2016 as against 40,488 units in Q1 2016; 16.5 percent quarter-on-quarter decline registered in Q2 2016 in revenue terms

According to International Data Corporation (IDC), server market in India declined by 16.9 percent quarter-on-quarter in Q2 2016, with 33,662 units shipped in Q2 2016 as against 40,488 units in Q1 2016. In terms of revenue, there was a 16.5 percent quarter-on-quarter decline registered in Q2 2016.

Periodic investments from cloud service providers, home-grown hosting providers and continued spending towards 4G deployments predominantly contributed to this quarter’s server demand. Digitization across the banking sector, piece-meal demand from e-commerce and payment banks further fuelled into Q2’s compute demand. Overall spending on server has normalized back to its usual average, and the trend is expected to continue in the coming quarter as well.

The non x86 server market declined by 25.2 percent quarter-on-quarter in terms of unit shipments and 3.7 percent in terms of revenue in Q2 2016. Communications & Media and Banking verticals continued to be the major contributors to this market. Internet banking initiatives, cyclic banking refreshes and continued investments from telecom providers majorly contributed to this demand.

According to Ruchika Kakkar, Server Market Analyst, IDC India, “Although there’s an evident slowdown in the server market, further investments towards 4G deployments, and expansions in the cloud and local data-centre space continue to remain in the pipeline. Realization of the GST bill and on-going consolidations in the banking and e-commerce space are also expected to increase server demand from early next year.”

According to Gaurav Sharma, Research Manager- Enterprise & IPDS, IDC India, “Market is expected to pick up on the back of enterprise demand propelled by refresh/upgrade, analytics and new digital projects requiring modern infrastructure. The emergence of cloud /DC buyers and white box players (in the mainstream) are two trends to watch out for.”

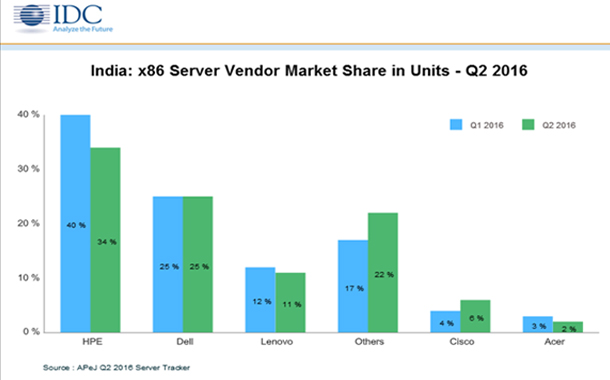

In India x 86 markets, HPE maintained its leading position in Q2 2016 with 34 percent market share in terms of unit shipment, followed by Dell with a market share of 25 percent. Lenovo’s market share dropped further to 11 percent quarter-on-quarter. White box providers gained marginal market share of 2 percent, up from 11 percent in Q1 2016 to 13 percent in Q2 2016; however, they witnessed 6.1 percent decline in terms of absolute unit shipment quarter-on-quarter. Cisco’s market share rose by 2 percent quarter-on-quarter, while Acer’s share dropped by 1 percent.

On the revenue front, HPE continued to lead with 37 percent market share, followed by Dell at 27 percent market share. Cisco’s market share stood at 12 percent in Q2 2016, closely followed by Lenovo at 10 percent.

Government backed Smart City Projects and Digital India drive are expected to draw sizeable compute demand through the next few quarters. Ongoing banking refreshes and digitization initiatives are expected to propel server demand across most verticals including Professional services, Banking, Education and Manufacturing.