Return to revenue growth: +1.3% at constant currency

Atos announces its FY 2022 results. Atos’ leadership team, Nourdine Bihmane, Diane Galbe and Philippe Oliva, declared: “Atos’ recovery is well underway thanks to the strong commitment and dedication of our 111,000 employees. In 2022, the Group returned to growth, at +1.3% at constant currency, and achieved all its financial objectives with a clear improvement in all KPIs in the second half of the year. In particular, Evidian started to accelerate its profitable growth and Tech Foundations delivered fast and tangible first results on its strategic roadmap, turning profitable three years ahead of plan.

We embrace 2023 with confidence. Our envisioned separation, towards which we have achieved significant progress within only eight months of its announcement, will be a turning point in the Group’s history, unleashing the full potential of both future entities and maximizing value for all our stakeholders. Despite an uncertain macroeconomic context, we see a wealth of opportunities ahead of us and are confident in our capacity to continue improving our performance through 2023. We are laying strong foundations for renewed success, for Atos today and, tomorrow, for both the Evidian and the Tech Foundations perimeters.”

2022 performance highlights

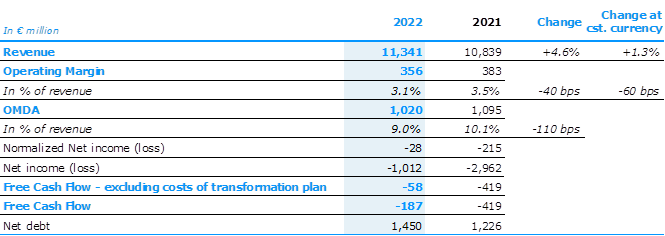

Group revenue was € 11,341 million in 2022, up +4.6% compared to 2021. At constant currency, revenue grew +1.3%, at the high end of the Group’s guidance, with an organic stabilization over the full year (+0.1%) and a +1.2% contribution from acquisitions net of disposals. Organic growth turned positive in H2, at +2.3%, with a strong Q4 at +4.6%[1]. Evidian’s revenue was € 5,315 million, growing +4.8% at constant currency and +2.0% organically. Organic growth accelerated in H2, to +5.4% (Q4 at +11.0%), driven by the ramp-up of Advanced Computing, steady strong growth in cybersecurity services where Evidian capitalizes on global leadership, and an acceleration in Digital. Tech Foundations’ revenue was € 6,026 million, decreasing by only -1.6% organically, a sharp improvement compared to 2021 (-11.4%). Following an earlier-than-anticipated stabilization in Q3, Tech Foundations accelerated the rationalization of its portfolio in Q4, particularly in BPO and value-added resale. Excluding non-strategic activities (BPO, VAR, UCC), Tech Foundations’ Q4 organic growth was +1.0%[2].

Operating margin was € 356 million, or 3.1% of revenue. In a context of high-cost inflation (salaries, energy) and supply chain tensions, Atos managed to drastically improve its operating margin in H2, to 5.1%, after 1.1% in H1, thanks to vigorous performance improvement actions focused on structure costs (unwinding of the Spring program, selective hirings, better cost discipline), underperforming contracts and pricing. Over the full year, Evidian’s operating margin was € 276 million, or 5.2% of revenue. Tech Foundations’ operating margin turned positive in 2022, three years ahead of plan, to € 79 million or 1.3% of revenue.

Free cash flow was €-187 million in 2022, including € 129 million of costs related to the Group’s transformation plan. Excluding these costs, Free cash flow was € -58 million, a strong improvement compared to 2021 thanks to a strict control of working capital, as well as a € 60 million refund related to the early termination of the German restructuring plan announced in July 2021.

Net debt was €-1,450 millionat the end of December 2022, or 2.4x pre IFRS 16 OMDA, providing ample headroom to the Group’s bank debt covenant of 3.75x. Having successfully refinanced its bank debt in July 2022, Atos is adequately funded. The Group’s liquidity remains solid, with € 3.3 billion of gross cash and €2.0 billion of undrawn credit facilities at end December 2022.

Book-to-bill rebounded sharply in Q4, to 112%, compared to 71% in Q3, with both perimeters improving markedly. Evidian’s book-to-bill was 130% in Q4, driven by both Digital and BDS. Tech Foundations started to reap the benefits of its refocused commercial strategy, with Q4 book-to-bill at 94%, driven by large contracts and a sharp increase in net new logos. This renewed commercial traction demonstrates Atos’ strong positions in its core markets and the intact attractiveness of the Group’s offering.