IDC India’s report reveals that India’s Hard Copy Printing market witnessed sequential decline in Q1 2016 as laser printer grew by 15.9 percent

According to the International Data Corporation (IDC), HCP market in India dropped 2.2 percent sequentially in Q1 2016 and reached 795,451 units in terms of shipments. HCP market in India was primarily driven by Laser Printer, which marked a remarkable sequential growth of 15.9 percent in Q1 2016.

According to Maninder Singh, Market Analyst, IDC India, “In the absence of substantial demand from Government and consumers in Q1 2016, the overall HCP market witnessed weak buying as the sentiments were not positive.. However, the enterprise segment witnessed some growth and is expected to pick up pace in the coming quarters.”

Major Vendor Analysis

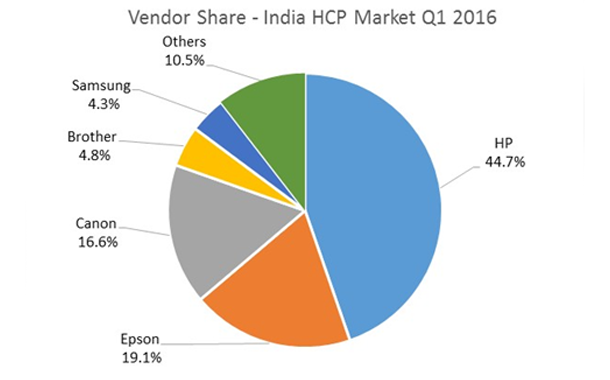

HP managed to achieve 44.7 percent shipment share in Q1 2016 and remained as the market leader in India. This was followed by Epson and Canon with 19.1 percent and16.6 percent share respectively. Brother emerged into the fourth position in Q1 2016 and was closely followed by Samsung.

Inkjet HCP market witnessed a sequential decline of 13.7 percent in Q1 2016 due to low consumer demand and high inventory. However, Epson and Brother witnessed a sequential growth of 6.2 percent & 12.4 percent in Q1 2016.Both HP and Canon in the Inkjet HCP market recorded sequential decline . All the vendors faced inventory issues during the start of the quarter but the second half witnessed new campaigns and marketing activities that are expected to pave the recovery path in the coming quarters.

In the Laser segment, printer-based Laser HCP market grew by 5 percent in terms of unit shipments in Q1 2016 as compared to Q4 2015. Financial year ending pushed many corporates and enterprises to exhaust their budget which supported the Laser market growth. The surge in Medium and Large Enterprises business was the prime reason for the growth and it was also supported by the stable channel business. HP continued to be the market leader with 57.7 percent market share, followed by Canon and Samsung at the second and third position respectively.

In the copier-based Laser HCP, the market witnessed sequential growth of 31.5 percent in Q1 2016. Q1 traditionally remains strong for Copier market and the trend continued this year as well. This was primarily due to strong Enterprise buying but demand from the Government segment was weak this time. Ricoh’s market share was 19.5 percent in Q1 2016 followed by Konica Minolta who recorded a sequential growth of 24.9 percent and moved to the second position in Q1 2016, followed by Kyocera Document Solutions at the third position.

According to Manali De Bhaumik, Senior Market Analyst, IPDS, IDC India “In Q1, the HCP market was driven by rise in laser segment due to increased Government and Corporate spends than Inkjet which suffered a loss due to less consumer spending. The market is expected to revive in the coming quarters.”

IDC forecasts that with increase in income levels, better education facilities, improved job prospects and low cost of living, Tier 3 & 4 cities & towns are the new playing field for printer vendors which will bring them the next phase of growth. In the Inkjet market, there is a shift towards the CISS (Continuous Ink Supply System) printers, which are more efficient and offer lower per page printing cost to the end users. In the Laser segment, demand for the higher speed products is increasing as Medium and Large Enterprises are looking not just for the hardware but the overall solution, which can be integrated to their existing business environment with higher productivity and efficiency. This is expected to further open up the services based market in India.