APEJ blockchain spending to grow at a robust pace with a five-year CAGR of 90.70% from 2016-2021

Asia Pacific excluding Japan (APEJ) spending on blockchain solutions is forecast to reach $281.69 million in 2018, almost double the $148.76 million spent in 2017, according to the first-ever IDC Worldwide Semiannual Blockchain Spending Guide. IDC expects APEJ’s blockchain spending to grow at a robust pace over the 2016-2021 forecast period with a five-year compound annual growth rate (CAGR) of 90.70% – faster than the projected worldwide growth of 81.21%.

“Blockchain technologies are being adopted by a wide range of industries across the Asia Pacific region,” said Simon Piff, Vice President, IDC Asia/Pacific (Singapore). “While many of the use cases are coming from the financial services industry; in markets as diverse as Australia, Thailand, and Singapore, we are also seeing strong acceptance across the entire supply chain, from food provenance, to logistics”.

IDC also noted that government regulators are taking advanced steps in adopting this technology from financial regulators looking to improve settlements, to port and customs authorities looking to drive efficiency and improve integrity and velocity of many traditionally paper-based transactions. Much of the work is in its early stages as evidenced by the proof-of-concept projects amongst organizations and governments in the region.

China will see a phenomenal five-year CAGR of 95.00%, with Asia Pacific excluding Japan and China following closely with an 86.14% five-year CAGR. “Financial services is the overwhelming forerunner in deploying a collaborative approach to Blockchain adoption. However, discrete manufacturing and retail industries will not be far behind; given the fact that manufacturers & retailers will be given enhanced visibility, accountability and transparency on the global supply chain level and industrial processes. This level of enhanced verification will lead to Blockchain’s quick adoption,” said Swati Chaturvedi, Senior Market Analyst, Customers Insights & Analysis, IDC Asia/Pacific.

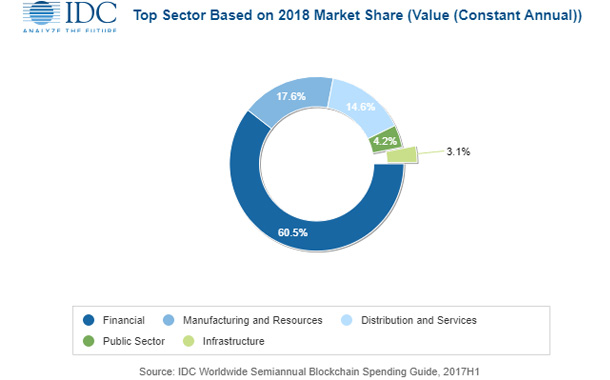

Blockchain spending will be led by the financial sector driven largely by rapid adoption in the banking industry, far followed by the manufacturing and resources sector. Within the financial sector, blockchain lends itself to several common use cases including regulatory compliance, cross-border payments & settlements, custody and asset tracking, and trade finance & post-trade/transaction settlements. Cross-border payments & settlements will be the use case that sees the largest spending in 2018, followed by trade finance & post-trade/transaction settlements and regulatory compliance.

From a technology perspective, IT services and business services (combined) will account for roughly 60% of all blockchain spending throughout the forecast with spending well balanced across the two categories. Blockchain platform software will be the largest category of spending outside of the services category and one of the fastest growing categories overall, along with security software.

The Worldwide Semiannual Blockchain Spending Guide quantifies the emerging blockchain market by providing spending data for ten technologies across 19 industries and 14 use cases in nine geographic regions. IDC defines blockchain as a digital, distributed ledger of transactions or records. The ledger, which stores the information or data, exists across multiple participants in a peer-to-peer network. There is no single, central repository that stores the ledger. Distributed ledgers technology (DLT) allows new transactions to be added to an existing chain of transactions using a secure, digital or cryptographic signature. Spending associated with various cryptocurrencies that utilize blockchain and distributed ledgers technology, such as Bitcoin, is not included in the spending guide. Unlike any other research in the industry, the comprehensive spending guide was designed to help IT decision makers to clearly understand the industry-specific scope and direction of blockchain spending today and over the next five years.