The BPaaS solution leverages company’s Artificial Intelligence platform ‘Wipro HOLMES’

Wipro has rolled-out ‘enterprise-Know Your Customer (e-KYC)’, an automation solution for global financial institutions, built on the company’s Artificial Intelligence platform ‘Wipro HOLMES’.

The solution, being offered as Business-Process-as-a-Service (BPaaS), will address the requirements of banks, insurance companies, brokerage firms and non-banking financial institutions, in a ‘services and outcome based’ business model announced the press release.

Know Your Customer (KYC) is a business process to verify the identity of customers. Evolving regulatory reforms require financial institutions to significantly strengthen their KYC and customer on-boarding processes and practices. As a result, the processes around the collation, validation, safeguarding and monitoring of potential customers’ identification and financial information have become crucial.

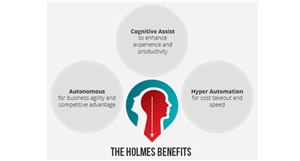

Wipro HOLMES, an outcome of four years of research and development, and built on open source technologies, addresses key domains in cognitive computing. Software bots built on Wipro HOLMES platform can be used to automate industry specific business processes.

Wipro’s e-KYC solution uses a library of Wipro HOLMES bots to automate the manual processes of KYC, such as information aggregation, extraction and verification.

The solution will help clients achieve cost savings upto 35%. It will also enable greater accuracy, improved customer experience and assurance of better quality KYC, in line with regulatory requirements. This solution has been designed around key aspects such as natural interaction, multi-structured information processing, machine learning and reasoning.

Nagendra P Bandaru, SVP and Global head (Business Process Services), Wipro Ltd, said, “Post the last global financial downturn, regulators have raised the bar on KYC obligations, because a sound KYC process is integral to a robust financial services ecosystem. We are confident that our enterprise-KYC solution will help our customers in the financial services industry fulfill their regulatory obligations in a significantly more effective and efficient manner.”