ICICI Lombard is at the forefront in adopting technology solutions to offer a holistic experience to its customers throughout the customer engagement

Macro Trends – Context Setting

- Large scale shift to digital by consumers across geographic, socio-economic and demographic strata necessitates a comprehensive digital roadmap that takes into account location, age, language, device variance etc.

- At ICICI Lombard, we have been early adopters of technological and digital tools across multiple functions i.e. Underwriting & Claims, Operations, Sales & Distribution etc.

- We were the first general insurer to launch an online sales platform in 2005.

Technology @ICICI Lombard

Technology plays the role of an enabler in our business:

- Value adding proposition in our customer acquisition/ retention strategy

- Differentiated experience for customers and other stakeholders (e.g. channel partners)

- Facilitate cost and process efficiencies across functions

Technology enabled customer solutions (B2C)

- Business Acquisition

- Website: We have a robust website that we have recently revamped to create a ‘Mobile First’ design. The website empowers our customers to purchase/ renew their policy and also intimate a claim apart from a host of other facilities. This is in line with the customer behavior to access our website through the mobile device.

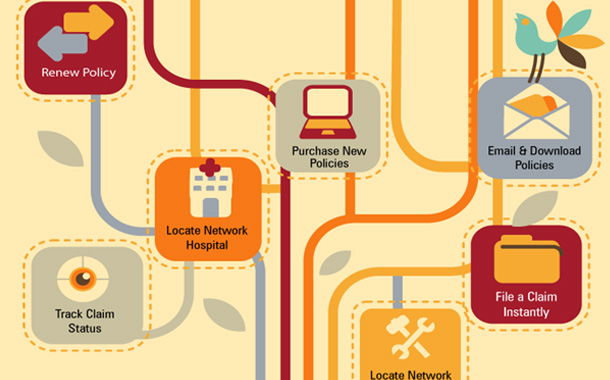

- Insure App: Our customer focused app, Insure, empowers customers to purchase/ renew or extend their policies and also intimate a claim. They can trace the nearest hospital or garage and also receive notifications for their policy and status of their claim intimation.

- Mobile Self Inspection: This unique solution for customers enables hassle-free renewal of their lapsed motor insurance policy. Traditionally, when a motor insurance policy expired, a mandatory inspection was required to be done by a surveyor which was time-consuming. With the ‘Mobile Self- Inspection’ feature, customers can conduct the vehicle survey themselves by uploading a self-inspection video on ICICI Lombard’s ‘Insure’ app. The video is reviewed by ICICI Lombard personnel as per the underwritten guidelines. Once approved (within a few hours), the customer can pay online and the policy is renewed customer can pay online and the policy is renewed.

- Photo Quote feature: This feature in our mobile app ‘Insure’ allows a customer to share a photo of the existing motor policy (any company) and receive a renewal quote with all insured and vehicle details populated. If ok with the pricing, the customer can pay from the app directly and a policy is issued instantaneously.

Solutions for Channel Partners (B2B)/ intermediaries and Networks

- Policy Issuance & Servicing

- ‘iPartner’: iPartner is state-of-the art Point of sales software deployed with the Agent, Corporate Agents, Brokers and Bancassurance Partners. It is a great tool which enables the intermediaries to issue new policy for customers and to service the renewals of the existing customers over the counter for Motor, Health, Travel & SME lines of Business with significant ease. It allows the customers to pay through multiple financial instruments too including cheque, payment link for payment through Debit Card, Credit Card & Net Banking. Penetration of IPartner will be around 75% in emerging markets and 55% in vertical markets for Motor Class of Business while for Health Class of business its penetration would be around 60%. iPartner is part of our philosophy to empower our channel partners and to enable them with right set of tools to increase their business.

- Allow channel partners to obtain offline quotes, share quotes through What’s app, email and SMS to their clients.

- Auto-populate customer details from Aadhaar.

- Provide customer service facilities e.g. sending renewal notice, printing health cards, suggest nearby diagnostic centres and hospitals in the network.

- Allow the agent to send premium payment link to the customer.

- Enable the agent to view his business MIS and renewal calendar.

- Risk assessment app: ‘Risk Inspect’ app captures risk information of low sum insured property risks. One can take photos through the app and geocode them to identify risk location. The app captures data points across parameters such as General Layout, Construction, Utilities, Storage Practices, General Housekeeping, Fire Fighting and Security, Risk Specific Hazard and Geographical risk features. After completion of the inspection, the app synchronizes the data with the ICICI Lombard Risk Rating system and generates a Risk score which is sent to the underwriter. Also, the app automatically generates a risk advisory report and shares it with the client. Moreover, the app is capable of operating without internet connections and later synchronizing the data on availability of internet, hence making it feasible to inspect remotest of locations without any hiccup. The app has been facilitating inspection of 3 times more risk locations in recent times.

- Mobile Printers: To push the penetration of two wheeler insurance, we introduced mobile printers that are connected to onsite laptops (that run our ILPOS software) and enable the ground personnel to instantaneously issue a policy document in no time. The policies are then synced with our central servers at the end of the day.

- Underwriting & Claims:

- E-Cashless Module: Our e-cashless module enables hospitals to create cashless requests directly in the claims processing system. We process 70% of hospital transactions through e-cashless mode.

- Claim Process Automation: We have automated our claims payment process and pay 97% claims today through this system compared to 40% in FY2011.

- Claims Assist: This system helps customers to schedule the survey online under our Insure app. On the scheduled date, customers have to take can do a live video of the vehicle which gets uploaded inside the IL Insure app. The video is reviewed by ICICI Lombard claims manager live as per the underwritten guidelines. Once approved (within a few hours), the claim is paid. Customers can check the status in the ‘manage your claims status’ of the app section post the survey.

- Operations:

- Motor Damage Surveys: More than 90% of our Surveyors assess and record vehicle damage using tablets that are connected to central servers, eliminating the need for them to carry physical forms to office, thereby reducing time and operational cost.

Value added services:

ICICI Lombard continually strives to enhance its product and service offerings with the intent to ensure a hassle free experience for its customers and business partners. We have designed solutions which will cater to their needs throughout the policy lifecycle. Our new offering is one such solution which helps us provide differentiated risk solutions to our customers with a plethora of benefits.

IL Assist: This unique proposition helps us offer multiple benefits to our customers. 24×7 support in case of a vehicle breakdown, real time update on vehicle location thereby preventing them from theft and other crimes, customized vehicle alerts, geo- fencing, usage report. This device helps customers to stay connected with their car all the time even when they are not in the car. It keeps them safe by alerting on various parameters like over-speeding, geo fence violation, towing and also notifies vehicle health by diagnosing the vehicle on real time basis. The Telematics device provides a host of information right from the location of the car to driving pattern and health of the vehicle. Additionally, it provides a digital locker for storing vehicle documents on expiry alerts and also notifies the customers about fuel economy tracking.

ChatBot Projects

4 projects are under implementation. 3 are live, 1 is ready to go live and one under development. Given below are the details.

Project 1: Purchase / Renewal of Two wheeler policy. (Status: Live)

Key Benefit: Automated and seamless end to end purchase/ renewal process that has made it possible for customers to renew at their convenience. Transaction time has reduced drastically, no human intervention required to respond to customer queries.

Usage details are as below:

| Date | Total User | Quotation | Policy |

| Total | 37691 | 4221 | 462 |

Project 2: Email based quotation for Fire insurance purchase. (Status: Live)

Key Benefit: Direct communication from agent to robot to seek quote on proposed fire risk, enables faster quote generation and policy issuance. No human intervention required for quote generation.

Usage details are as below:

| Date | Count of mails processed | Quote provided through QMS | Quote provided through OTC | Quote provided through I-Partner |

| Total | 1612 | 374 | 363 | 442 |

Project 3: ChatBot on Yammer for Employees (Status: Live)

Key Benefit: A tool where in the employees can get their queries resolved on HR policies, real time and can also perform employee life cycle transactions. No human intervention required from HR end to resolve queries. The Chabot can be accessed through the desktop/ laptop as well as mobile device from anywhere and at any time.

Project 4: Renewal of Health policy through ChatBot on Facebook (Status: Under Development)

Key Benefit: Similar benefits to two wheeler purchase / renewal chatbot except that platform being used is facebook (web in case of two wheeler chatbot).