New report from Capgemini’s Digital Transformation Institute finds positive correlation between investment in digital customer experience initiatives and customer satisfaction and willingness to spend more

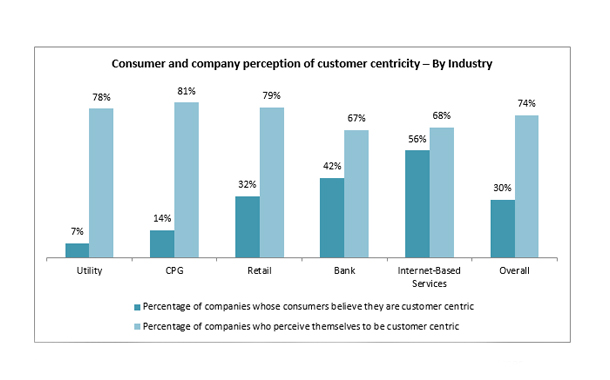

Capgemini has announced the findings of “The Disconnected Customer: What digital customer experience leaders teach us about reconnecting with customers”, a study of more than 3,300 consumers and 450 executives at the companies that serve them. The research reveals a gap between how businesses and consumers perceive the quality of their customer experience. While three-quarters (75%) of organizations believe themselves to be customer-centric, only 30% of consumers agree. Frustrated by organizations that don’t listen to their feedback or reward their loyalty, the majority of consumers are willing to increase their spend with an organization in return for a better experience (81%). Yet, nearly a third of businesses (31%) say they face a challenge in keeping up with the rapidly evolving technology landscape and consumers’ digital expectations.

The report, which surveyed consumers across Australia, China, France, Germany, India, the Netherlands, UK and US, provides a reality check for big businesses in their efforts to deliver better customer experiences through digital. Not only is there a big disconnect between businesses and consumers on what represents customer centricity but also on whether the customer experience is improving. Capgemini used the industry standard Net Promoter ScoreSM (NPS) model – an index ranging from minus 100 to plus 100 that measures the willingness of customers to recommend a company’s products or services – to gauge consumer satisfaction. 90%of companies believed that their organizations’ NPS® had increased by 5 points over the last three years, however, half of consumers agreed (54%).

The report also highlights significant differences between industries. Internet services companies and their customers are almost in step and setting the bar for other organizations, while utilities and consumer products companies have a long way to go to meet consumer expectations.

Only three in ten of the 125 unique organizations identified in the study are matching their customers’ expectations. For the remaining 70%, the rewards for delivering a better experience are high as8 in 10 consumers (81%) indicate that they are willing to spend more with an organization for a better customer experience, and1 in 10 (9%) consumers would increase spend by more than a half. Consumers in India (98%) and China (95%) are most likely to reward good experiences with increased spend, while those in Germany (61%) and The Netherlands (72%) are least likely.

For consumers, digital is key to meeting expectations. Capgemini’s Digital Transformation Institute evaluated organizations across 80 different digital experience attributes – ranging from the ability to view and edit personal data to personalizing products and services on mobile devices – to create a Digital Customer Experience (DCX) Index. The more digital attributes an organization has deployed – and the more advanced those digital attributes are – the higher its DCX Index score . When mapped against consumers’ willingness to spend more and NPS, Capgemini discovered that for each single point increase in the DCX Index score consumers would be willing to spend 0.6% more with an organization and the NPS then also increases by nearly 5 points. The report shows that the DCX Index is strongly correlated to the NPS of a company (correlation coefficient: 0.73). The study also found that the top ten companies with the highest DCX Index saw their share prices increase by 16% per year over the last five years whereas the bottom ten players increased their share prices by only about 6% on average.

Companies who closely link their business operations with customer experience (6%) enjoy a 14-point NPS advantage compared to companies whose business operations are not connected to customer experience (33%). Companies with close linkage also experienced double the increase in their NPS (12 points) over the last three years.

Pierre-Yves Glever, Global Lead of Digital Customer Experience at Capgemini said, “Digital has enabled new ways of engaging consumers but is also driving new behaviors and creating new expectations. It’s clear that many organizations are struggling to keep up with the pace of change. As our research reveals, experience is the new battleground, and how you connect will determine how you win. Organizations that tightly link their business operations with customer experience will reap the benefits in both streamlined operational efficiency and customer satisfaction.”

Less than two in ten organizations (19%) are meeting consumers’ expectations. For those that aren’t, the challenges are both organizational and technical. The rapidly evolving technology landscape (56%) and rising consumer expectations (57%) are cited as the major IT challenges, above integrating disparate platforms (38%) or a poor user interface(32%) indicating that while many organizations have cracked the digital basics the relentless evolution of technology is a major problem for them. Businesses also cite a lack of dedicated customer experience budgets (41%) and internal ownership of the digital customer experience (35%), suggesting that many organizations are still not prioritizing digital as a means of driving competitiveness and growth.

This research provides insights into digital customer experience and how organizations can create a better experience for customers. The report covers the views of 3,300 respondents who are customers of 125 companies, drawn from Utilities, Consumer Products, Retail, Retail Banking, and Internet-based services. Geographically, they were drawn from Australia, China, France, Germany, India, Netherlands, the UK, and the USA. The research also surveyed 450senior executives from 150 companies (3 from each company) from the same countries noted above. The senior executives surveyed were from three key functions of each company: customer experience/service, IT/technology, and marketing/sales.