Applications help banks, telecommunications companies, government agencies and manufacturers make more informed decisions in order to reduce losses

Accenture is launching seven new advanced analytics applications to help organizations more effectively detect and remediate fraud, and ultimately reduce losses to improve their bottom lines. Designed specifically for banks, telecommunications companies, government agencies and manufacturers, the applications provide users with tailored analytics insights via visualizations that can enable more confident, data-driven decisions on strategies to address fraudulent activity.

According to the press release, the new applications were developed in the Accenture Analytics Innovation Center in Dublin, Ireland, Accenture’s global center of excellence for predictive analytics that targets fraud, abuse and non-compliance. The new advanced analytics applications include Early Warnings and Trade Surveillance for banks, Audit Operations Efficiency, Revenue Fraud Prediction and Spend Optimizer for Government agencies; Predictive Fraud Detection for telecommunications companies and Warranty Analytics for manufacturers.

The new applications join the fraud management apps that are currently available: Claims Fraud for insurance companies; Fraud Detection for retailers; and Energy Fraud Detection, and Credit Collection for resources industries that include energy and utilities companies.

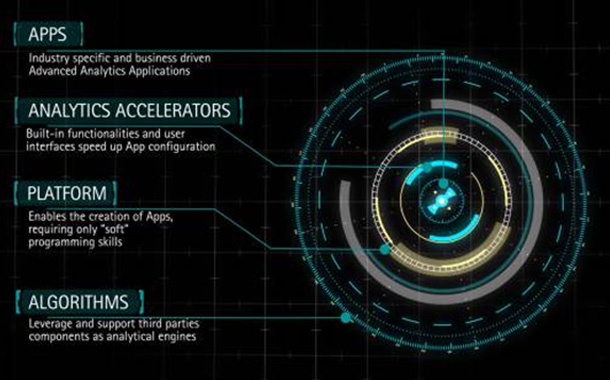

The Accenture Insights Platform, a cloud-based end-to-end analytics solution, hosts the advanced analytics applications portfolio and an integrated design, build, and run environment that enables the agile development of industry and function-specific analytics applications. In addition to using the applications through the platform, organizations have the option of using them on their own. Accenture’s advanced applications are customized to meet an organization’s specific needs – they are integrated with an organization’s unique operational workflow process and designed for a specific user. Depending on the level of customization needed, applications can typically be ready for use in approximately a few weeks to 60 days.

Kieran Towey, Managing Director, Accenture Analytics said, “As fraudulent behavior can come in many different forms and morph quickly to stay under the radar, organizations across industries are seeking solutions that can help them to quickly identify and reduce this activity to decrease losses. Recognizing the need for speed, Accenture’s new analytics applications can be ready for use in as little as a few weeks, informing more effective actions that can eliminate risky activities straightaway. The faster we can help our clients to find fraudulent and abusive activity, the faster the steps can be taken to end it.”