Fresh capital powers Databricks’ push into AI‑native databases and conversational intelligence.

Databricks has kicked off 2026 with a major milestone, announcing that it has crossed a $5.4 billion revenue run‑rate, growing more than 65% year‑over‑year in Q4. The company also revealed over $7 billion in new investments, including approximately $5 billion in equity financing at a $134 billion valuation, alongside $2 billion in additional debt capacity.

The fresh capital will help Databricks double down on two flagship innovations: Lakebase, its serverless Postgres database engineered for AI agents, and Genie, its conversational AI assistant designed to help every employee “chat with their data” and instantly access insights.

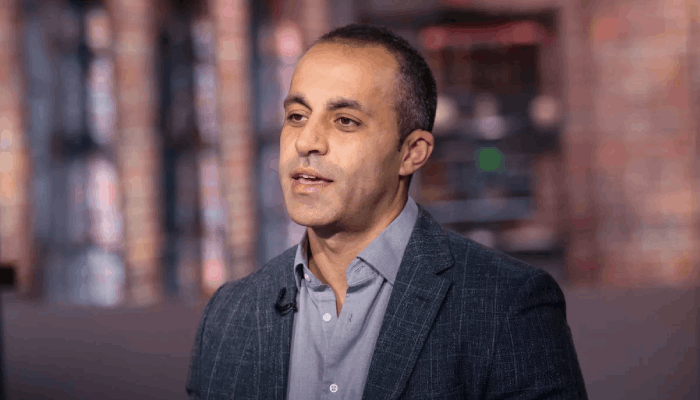

“We’re going after two new markets with overwhelming investor confidence behind us.”

Ali Ghodsi, Co‑founder and CEO, Databricks

The financing round saw strong participation from global investors, with JPMorganChase increasing its stake through its Security and Resiliency Initiative’s Strategic Investment Group. New and returning backers included Glade Brook Capital, Goldman Sachs Alternatives’ Growth Equity, Microsoft, Morgan Stanley, Neuberger‑affiliated funds, Qatar Investment Authority (QIA), UBS‑associated funds, and others. JPMorgan Chase Bank, N.A. led the credit facilities with support from Barclays, Citi, Goldman Sachs, Morgan Stanley, and other institutions.

Momentum Across the Business

Databricks’ rapid scale‑up is underscored by several key metrics:

- Revenue run‑rate of $5.4B, up >65% YoY

- Positive free cash flow over the past year

- $1.4B revenue run‑rate from AI products

- Net retention rate >140%

- 800+ customers generating over $1M ARR

- 70+ customers generating over $10M ARR

Co‑founder and CEO Ali Ghodsi said the new capital will support Databricks’ expansion into two emerging markets: AI‑first operational databases and enterprise‑wide conversational data intelligence. “Developers will be able to build operational databases for AI agents, and employees everywhere will gain accurate, actionable insights through Genie,” he noted.

JPMorganChase’s Todd Combs added that Databricks has become “a backbone for enterprise data and AI,” enabling organizations to innovate securely at scale.

The company plans to use the funding to accelerate Lakebase, expand Genie’s natural language capabilities, deepen AI research, pursue strategic acquisitions, and provide employee liquidity cementing its position at the heart of the Data + AI revolution.